To create a small business compliance program should not be a cumbersome exercise. This is understandably so because a small business is different from larger organizations that have a long list of regulations and standards they must comply with while running the business.

Compliance is important. The goal of compliance is to prevent problems related to safety, the environment, suppliers, human resources, finance, and ultimately the customer.

Data management and cybersecurity both require a robust compliance program which is typically addressed under information technology.

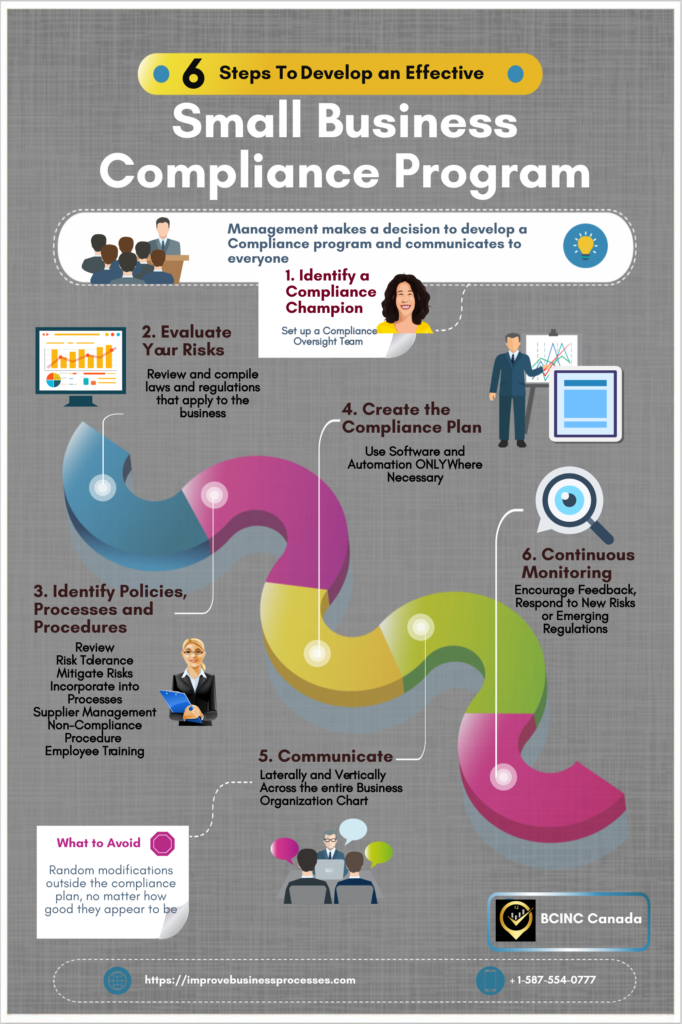

6 Steps to Develop an Effective Small Business Compliance Program

See infographic above

- Identify a Compliance Champion and set up a Compliance Team

- Evaluate Your Business Risks

- Identify Quality Documentation

- Create the Compliance plan

- Communicate

- Continuously Monitor for Assurance

Compliance Champion and Compliance Team

As with most things, failure to have someone accountable for driving the program simply sets up the business for failure.

Having a Compliance Champion or Officer to lead activities is a necessary starting point.

This is because a single person cannot fully understand all the risks and documentation associated with business operations.

Consequently, this is the reason for setting up compliance teams. In the case of a small business, this team should be a small one, otherwise there could be some counter productivity.

Evaluate Business Risks – Company Compliance Program

Having a team evaluate business risks creates a more thorough overview. The team will review and compile regulations and standards that apply to the business.

Are there any emerging regulations that affect the business?

Identify Currently Available Quality Documentation

Quality documents such as policies, processes, procedures, and checklists currently in use in all areas of the business must be tabulated.

These documents must be reviewed to identify where changes may be required to address compliance. It should include their storage location, retrieval methods and controls.

Will new documents need to be developed to mitigate risks? This exercise can take a fair amount of time and should not be rushed.

Create the Compliance Plan

In a nutshell, a Compliance plan is simply an audit plan to be used to check if the business is meeting its regulatory obligations.

Use software and automation only where necessary and most especially for manual repetitive tasks.

Automated tools – Small Business Compliance Program

- Save time

- Allow the monitoring of compliance in real-time, providing assurance that the business is compliant with regulations and standards,

- Minimize data breaches caused by human error

Communicate the Plan

Once the plan is completed and tested, it should be communicated to everyone in the business.

Continuously Monitor for Assurance

The use of static tools like checklists to monitor for compliance is inadequate because these only represent a snapshot in time.

By continuously monitoring for assurance, encouraging employee feedback, and responding to new risks or emerging regulations will ensure that non-compliance is kept to a minimum.

Periodic Compliance checks are also helpful.

Conclusion

A small business compliance program is a necessity for any business that wants to remain on the right side of the law.

Just as in the case of the taxman who you do not know when he might show up for an audit of taxes, the same is true of government compliance officers.

Many businesses think that because they have been operating for a few years without an audit means they are safe.

Maybe so for now.

What about tomorrow? Is your business willing to take that risk?

BCINC can assist you to develop a compliance plan for your business quickly and efficiently. Call or schedule a free exploratory session at https://improvebusinessprocesses.com/contact

Related Articles

References

The True Cost of Compliance with Data Protection Regulations: https://www.globalscape.com/resources/whitepapers/data-protection-regulations-study